Earning Interest

The next feature of a savings account is that it earns interest on the money you deposit into that account. What is interest on a savings account? In the simplest terms, it is money that you earn, and that the bank deposits into your account just for having your money at their institution. The amount of money that gets deposited is dependent on a couple of factors.

• Your savings account balance

• The Annual Percentage Yield (APY) at your bank

• Higher APY give you more interest income

• Compound interest which helps your money grow.

A savings account is an account opened at a financial institution designed to make deposits so that you can SAVE your money. Whether you choose a traditional bank, online bank, or a credit union, your money will be federally insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000. The FDIC protects your money, so if the bank goes out of business, you are still protected. Knowing that your money is safe will give you a sense of security.

Before you safely put your money into an account, what other items do you need to research when determining where to open the savings account?

Compound Interest and Savings Accounts

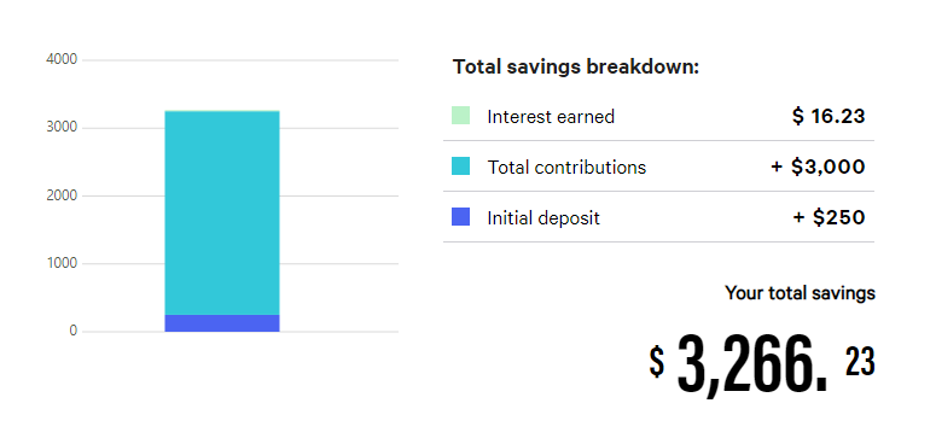

If your interest will be compounded monthly, the following should give you an idea of how compound interest works:

The interest is calculated and added to your balance, therefore increasing your balance in your account. The following month the interest is calculated again on the sum of your principal balance and the previously accumulated interest. With compound interest each month you accrue interest on top of interest, thus defining the concept of compounding interest.