Why is my loan repayment larger than the loan I took out?

A major chunk of a student loan is the interest. The interest is how the loan servicer makes a profit on lending. The interest is calculated as a percentage of the loan amount and will accrue daily. The interest is paid back in addition to the initial amount until the loan is paid in full.

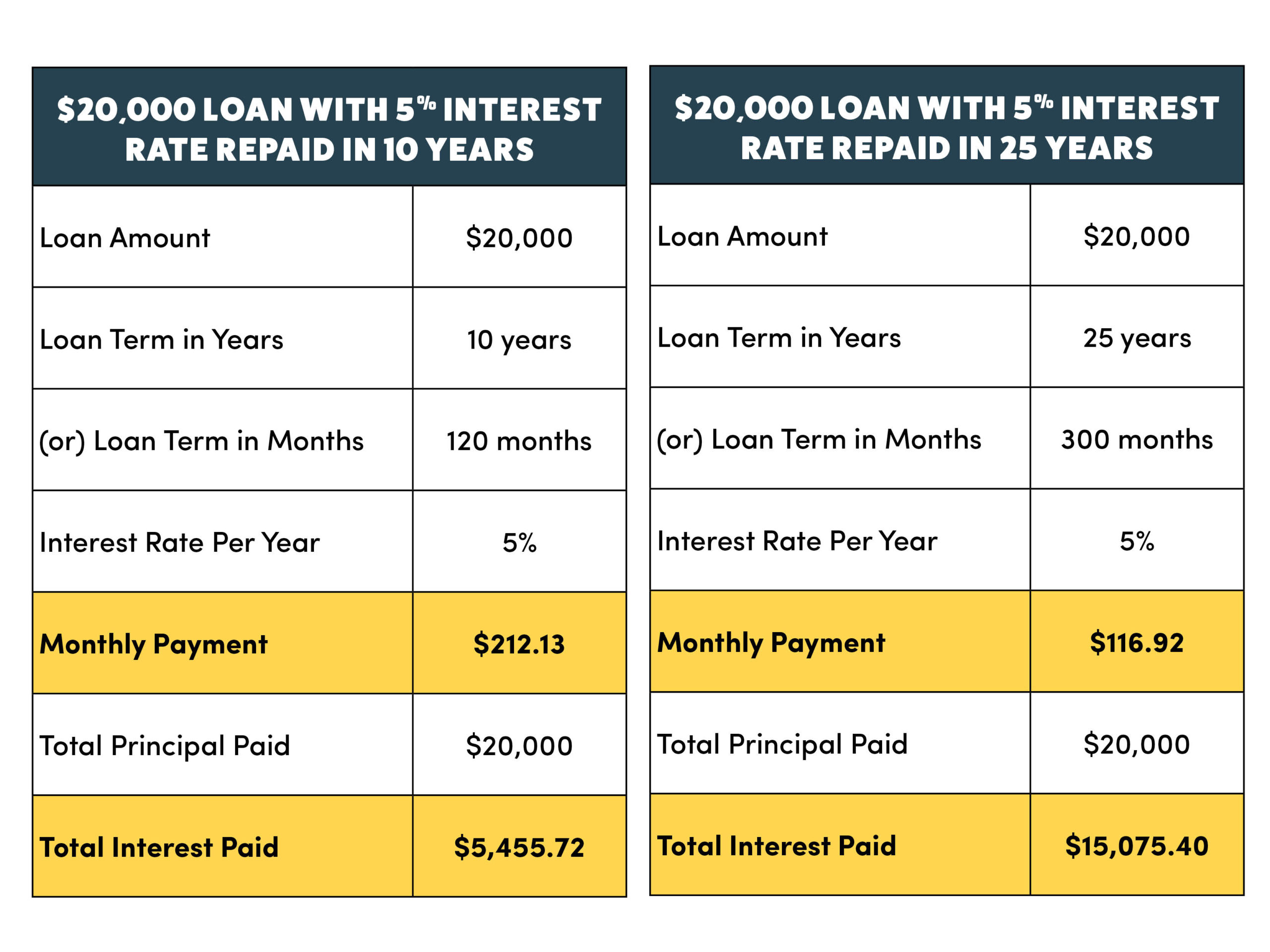

Review the differences between these two examples of a $20,000 loan with a 5% interest rate.