Interest will affect your entire financial life, so it is important to fully understand its influence so that you make the best decisions for your future.

These are the most common types of payments:

-

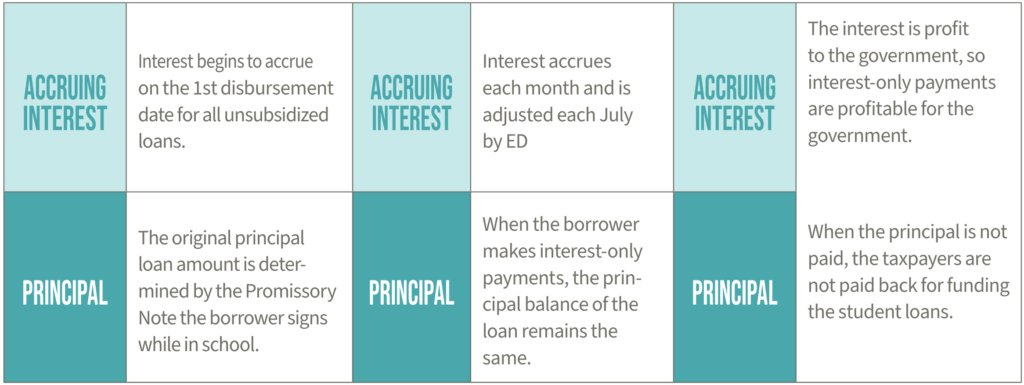

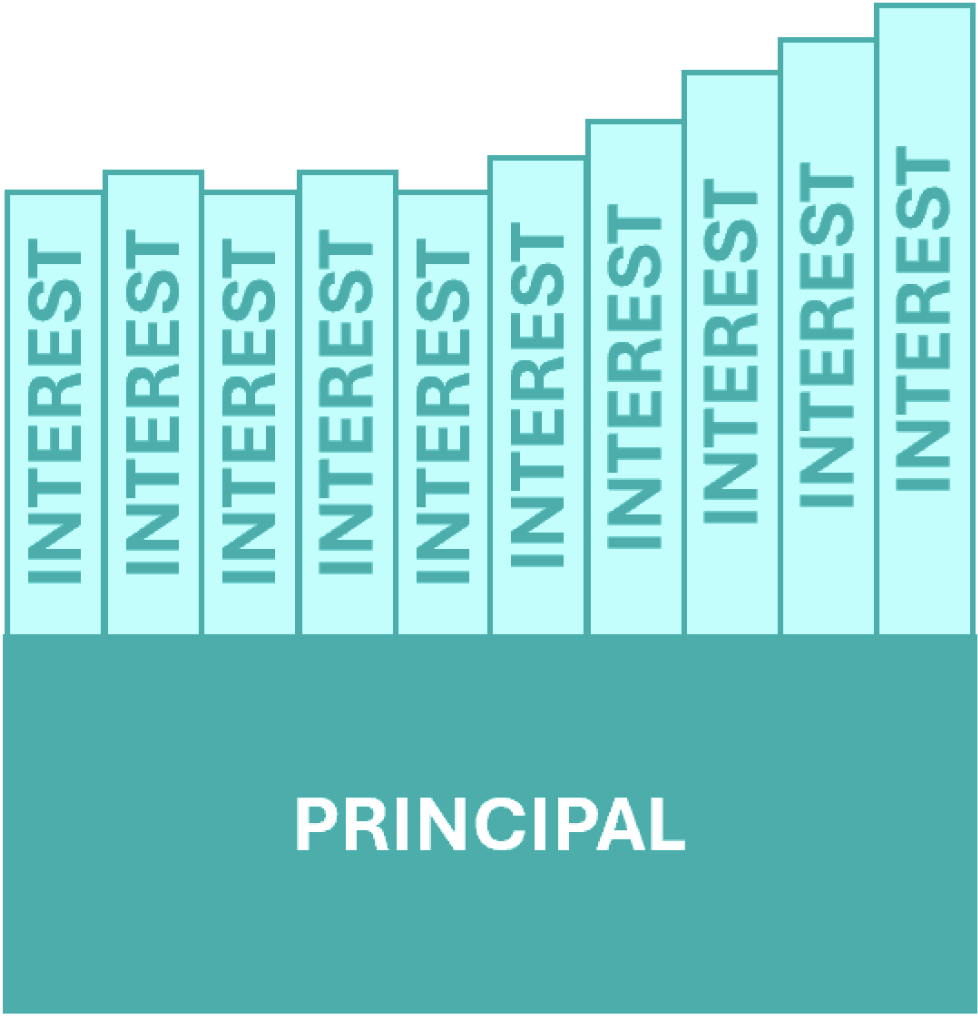

- Interest-Only Payments are made each month where only the accrued interest for that month is paid. The principal is not being reduced so this is an expensive option for financing.This type of financing usually has a limited time where interest-only payments are made, usually for 3-5 years, then the payments increase to include both principal and interest. Many people use this option when interest rates are higher, thinking they will refinance when the payments go up. This can be a bad plan when interest rates are higher, or credit is more difficult to obtain at the time the payments go up. It is important to plan for these higher payments in your budget way before the higher payments become due.

-

- This type of mortgage loan often ends up in foreclosure when payments increase.

-

- Fixed Rate Payments remain the same during the entire repayment period for the loan. Because the payments are predictable, this is the easiest to budget. During the repayment period, the interest is based on the principal balance of the loan. In the beginning, many of the payments are interest with little going toward principal reduction. Toward the end of the loan, many of the payments are principal reduction with little going toward interest.

-

- Variable Rate Payments are based on current interest rates. The adjusted payments can occur monthly to annually. When interest rates are going up, the payments increase and can become unaffordable. This type of mortgage payment is risky because people often can’t afford the higher payments and end up in foreclosure.

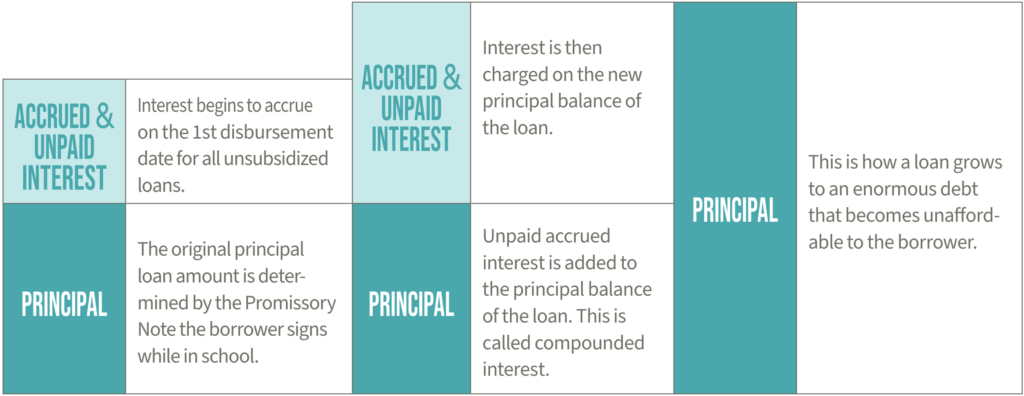

- Negative Amortization occurs when the monthly payment is less than the total accruing interest and only a portion of the interest is paid. The accrued and unpaid interest is capitalized monthly, annually, or at set intervals defined legally in the promissory note or credit agreement. This is an extremely expensive option for financing where the debt grows over time instead of being reduced.

-

- Balloon Payments are used in “short-term” financing where a loan is in repayment for a set period, like 3-5 years, then the loan must be paid-in-full or refinanced. If interest rates are high, borrowers often don’t qualify for refinancing and the loan defaults, or the home goes into foreclosure. This financing is extremely risky.

-

Key Thoughts on the influence of Interest on Payments

- Interest-only payments do not reduce debt and are usually made for a limited period. When payments increase to include principal and interest, they are often unaffordable for borrowers.

- Fixed rate payments remain the same through the repayment period and are the easiest to budget for.

- Variable rate payments change, can become unaffordable when interest rates are higher, and are difficult to budget for.

- Negative amortization payments increase debt because accrued and unpaid interest is added to the principal balance of the loan, and you pay interest on the unpaid interest.

- Balloon payments are not wise because they rely on the borrower’s ability to refinance the debt. If interest rates go up or the borrower’s financial situation changes, refinancing may not be an option and the borrower may default or go into foreclosure.