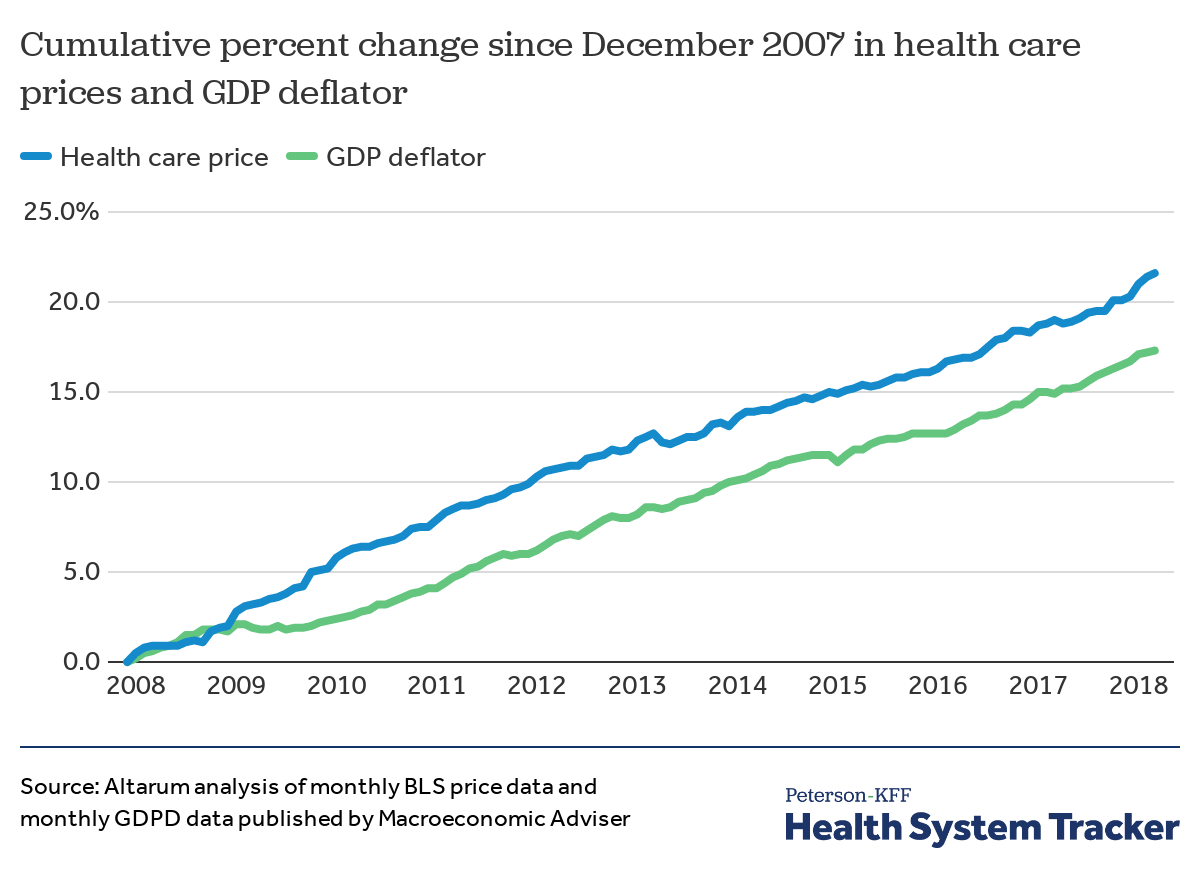

Continuously rising medical care costs in the United States have made health insurance a necessity because it provides access to care and protects against catastrophic loss. From 2007 to 2018, healthcare prices have grown by 21.6%.

The insurance needs vary by individual, based mostly on your age group or if you have preexisting conditions. Generally, if you are under 40, your insurance needs are minimal. The most likely claims for the under 40 age group are broken bones, injuries from accidents, and childbirth. Therefore, plans for this age group usually feature lower monthly premium costs, the coverage helps with catastrophic needs, and family plans are highly desired. After age 50, when our health care needs grow or become more complex, getting professional help from a licensed insurance agent can help you make the best possible decision.

Shopping for insurance is about identifying your coverage needs and finding the best option for you and your family. No two policies are precisely the same, so merely opting for the lowest premium or deductible is not necessarily the best choice. This guide will introduce you to the major elements of health insurance, the type of plans, where to get coverage, questions to consider, plus tips on comparing plans.