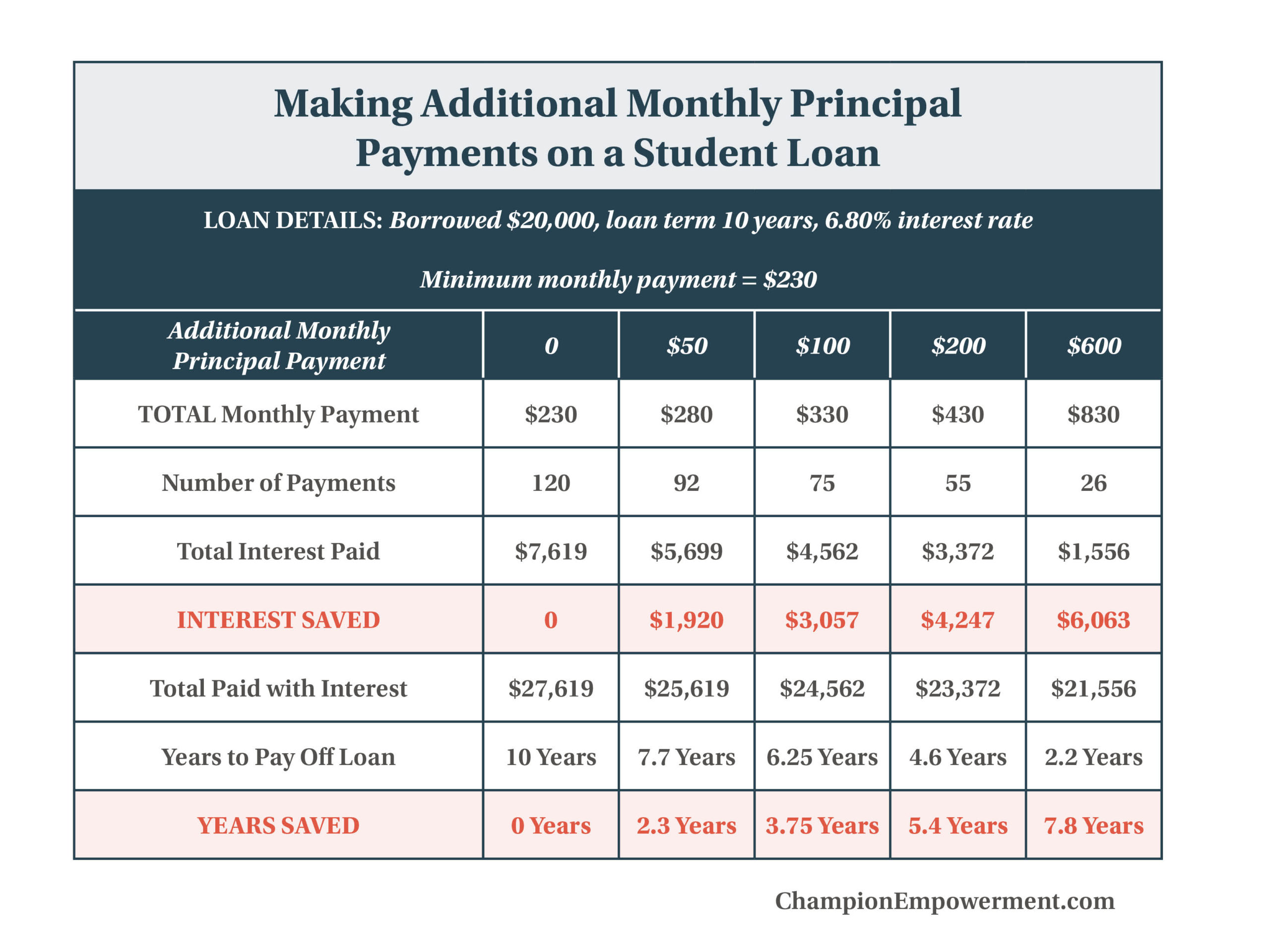

To give you a better idea about how much money you can save, review this example of a student loan for $20,000, where the borrower is making extra payments. In this example, if you pay $200 a month above the minimum payment, you would pay off your loan 5 years sooner and pay $4,247 or 55% LESS in interest.

That is pretty amazing!

But simply sending in extra money on your payments does NOT mean that money will be applied to your loan principal. It will take effort on your part to make sure your payment is applied correctly.